Table of Contents:

-

Quick Summary

-

The Flourishing Online Gaming Industry In India

-

Introduction Of 28% GST : Concerns And Controversies

-

Financial Burden On Fantasy Players

-

Potential Player Preference Shifts

-

Disproportionate Effects On Small Stake Players

-

Regulatory Challenges In Implementing The GST

-

Adapting Business Models For Sustaining Players Engagement

-

Conclusion

Quick Summary

In India, the online gaming industry has experienced remarkable growth, with Online fantasy sports becoming increasingly popular among players. However, the introduction of a 28% Goods and Services Tax (GST) on online gaming has sparked concerns and controversies within the industry. The GST is expected to impose a financial burden on fantasy players, leading to higher entry fees and reduced prize pools, potentially deterring casual players from participating. Moreover, the tax may result in a shift in player preferences as they explore alternative gaming options to avoid increased costs. Small stake players are also disproportionately affected, with potential implications on player motivation and an imbalance between high-stake and low-stake players.

This 28% GST has raised questions about its impact on the Online fantasy sports industry and the overall gaming landscape in India. As players, platforms, and regulators navigate these challenges, will this implementation impact the Online fantasy sports industry? Let’s study the situation.

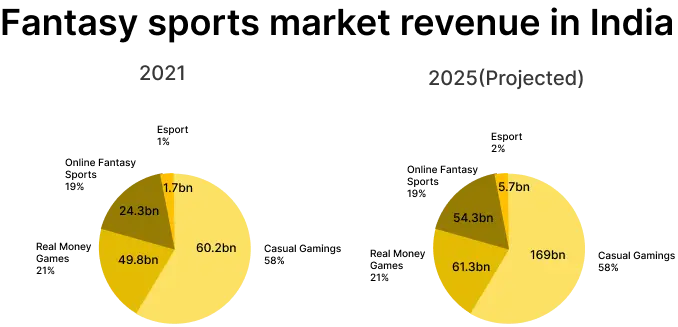

The Flourishing Online Game Industry In India

The flourishing online gaming industry in India has witnessed a remarkable surge in recent years, experiencing unprecedented growth and capturing the attention of millions of players nationwide. The sector has become a vibrant hub of virtual entertainment, with various gaming genres gaining immense popularity. However, as the specter of a 28% Goods and Services Tax (GST) looms over the horizon, concerns arise regarding its potential impact on this thriving and beloved Online fantasy sports landscape.

Soaring Popularity of Online fantasy sports:

Among the numerous gaming genres, Online fantasy sports has emerged as a clear favorite among players. The unique concept of creating virtual teams based on real-world sports players' performances has struck a chord with both sports enthusiasts and casual gamers. As the Online fantasy sports industry continues to flourish, the 28% GST on Online fantasy sports services has raised concerns among players and gaming platforms alike. Fantasy sports application development is happening rapidly in India. The potential impact of this tax on the thriving Online fantasy sports landscape remains a topic of discussion and warrants careful consideration by all stakeholders involved

Intoduction Of 28% GST : Concerns And Controversies

The Effects Of GST On India's Online Gaming Industry:

The recent incorporation of a 28% Goods and Services Tax (GST) on online gaming has triggered noteworthy apprehensions within India's gaming sector. Introduced by the government to streamline taxation and establish a harmonized tax framework, the implementation has sparked a series of deliberations and exchanges concerning its potential consequences across different industries, notably the thriving online gaming domain.

Industry Concerns Over Potential Consequences For Players And Platforms:

One of the major concerns among industry stakeholders is the potential burden of the 28% GST on both players and gaming platforms. Online gaming has witnessed tremendous growth in recent years, attracting a massive player base across various age groups. With the imposition of GST, players may face higher costs while purchasing in-game items, subscriptions, or virtual currency, potentially dampening their enthusiasm to participate in gaming activities.

Impact On The Online Fantasy Sports Industry:

The Online fantasy sports industry, which has emerged as a popular sub sector within the broader online gaming realm, is also under scrutiny regarding the 28% GST. Fantasy sports platforms enable users to create virtual teams comprising real players and earn points based on their performance in actual sporting events. The applicability of GST on fantasy sports entry fees or transactions has sparked concerns among operators and players alike.

Potential Reduction In User Engagement And Retention:

The imposition of a 28% GST may lead to a decline in user engagement and retention within the online gaming and Online fantasy sports sectors such as fantasy cricket and fantasy football. Gamers may become reluctant to spend as much on virtual items, subscriptions, or fantasy sports entry fees due to the increased costs. This, in turn, could affect the revenue streams of gaming platforms and subsequently influence their ability to offer innovative features and experiences to users.

Legal And Regulatory Challenges:

The GST on online gaming has also raised legal and regulatory questions. As the online gaming landscape evolves rapidly, the interpretation and application of tax laws may prove complex. Additionally, clarifications may be required regarding the classification of various gaming services and the exact tax liabilities for operators and players.

Balancing Revenue Generation And Industry Growth:

While the government seeks to generate revenue through the imposition of GST, it is essential to strike a balance between taxation and fostering the growth of the online gaming industry. If the tax rate becomes overly burdensome, it could potentially stifle innovation, investment, and job creation within the sector. Finding a middle ground that ensures fair taxation while encouraging industry expansion remains a crucial consideration for policymakers. Striking the right balance between taxation and industry growth will be pivotal in determining the long-term implications of this move on the dynamic and evolving landscape of online gaming in the country.

Financial Burden On Fantasy Players :

As the implementation of the 28% Goods and Services Tax (GST) looms over the Online fantasy sports industry, concerns are mounting regarding the financial burden it might place on fantasy players. This article delves into the potential effects of the GST on the wallets of fantasy gamers, exploring how increased costs may impact entry fees, prize pools, and overall player participation.

Analyzing The Increased Costs For Players Due To The 28% GST Implementation:

The 28% GST on Online fantasy sports services could lead to a direct increase in costs for players. Online platforms offering fantasy sports typically charge entry fees for participants to create and manage virtual teams. With the GST levied on these fees, players may find themselves shelling out more money to participate in their favorite fantasy contests, impacting their overall gaming budget.

Potential Impact On Entry Fees, Prize Pools, And Player Participation:

As the GST imposes additional costs on Online fantasy sports platforms, operators might face the challenge of maintaining affordable entry fees for players. The increased tax burden may force operators to pass on some of the costs to the players, leading to higher entry fees. This, in turn, could dissuade some players, especially casual gamers, from participating, potentially affecting the overall engagement and enthusiasm within the Online fantasy sports community.

Striking A Balance Between Attractive Prize Pools And GST Compliance:

Online fantasy sports platforms often entice players with enticing prize pools, rewarding winners with cash or valuable prizes. This may influence how platforms allocate their revenue, as they need to consider both the tax obligations and player expectations. Striking a balance between offering attractive prizes and ensuring GST compliance becomes a delicate task for operators in maintaining player interest.

Want to build your own fantasy gaming application?

Contact UsImplications On Gaming Affordability And Inclusivity:

For many Online fantasy sports enthusiasts, affordability is a key factor that determines their level of participation. The GST could pose a challenge in maintaining gaming as an inclusive and accessible activity for players from diverse economic backgrounds. Ensuring that the tax implementation does not disproportionately impact low-income players becomes crucial for the long-term sustainability of the Online fantasy sports industry.

Exploring Alternative Strategies For Player Engagement:

Given the potential financial burden on fantasy players due to the 28% GST, operators might need to explore innovative ways to keep players engaged. This could include introducing loyalty programs, offering special discounts to mitigate the impact of the tax and retain player interest.

Fostering Industry Sustainability Through Cooperative Endeavors:

In the face of GST-related challenges, the Online fantasy sports industry stands to gain from joint initiatives among various stakeholders. By engaging in frequent consultations with players, industry associations, and government authorities, the sector can effectively find a harmonious equilibrium between taxation and nurturing the industry's enduring growth.

While operators face challenges in maintaining attractive prize pools and affordable entry fees, collaborative efforts and innovative strategies can help ensure the industry's long-term sustainability while keeping gaming accessible to players from all walks of life.

Potential Player Preference Shifts :

With the implementation of the 28% GST in the Online fantasy sports industry, there arises a compelling need to examine the likelihood of players seeking alternative gaming options. The increased taxation may prompt players to reevaluate their choices and gaming behaviors, considering platforms or activities that are not subjected to the same tax burden. As players weigh the impact of higher costs on their gaming experiences, the industry might witness shifts in player preferences, potentially affecting the dynamics and competitive landscape within the Online fantasy sports sector. Adapting to these evolving player choices becomes imperative for operators and stakeholders to sustain growth and maintain a loyal player base amidst the GST-induced transformations.

Disproportionate Effects On Small Stake Players

1. How The GST Affects Small Stake Players In The Gaming Community

For small stake players, every rupee counts, and 28% GST on gaming services can significantly impact their overall gaming budget. The additional tax burden may compel them to think twice before participating in fantasy contests, as their limited funds might not stretch as far under the new tax regime. This could lead to reduced participation and enthusiasm, potentially hindering the inclusivity and accessibility of the gaming community.

2. Examining The Potential Widening Gap Between High-Stake And Low-Stake Players

The GST's effect on small stake players may inadvertently contribute to a widening gap between high-stake and low-stake players. High-stake players, who are less sensitive to marginal increases in entry fees or transaction costs, may continue to participate without major disruptions. On the other hand, small stake players, who make up a significant portion of the gaming community, might experience a more substantial impact, leading to a potential disparity in their ability to participate and compete on an equal footing.

3. Impact On Player Engagement And Retention

Small stake players often form the backbone of the Online fantasy sports industry, constituting a large chunk of the player base. The GST's disproportionate effects on this segment of players could result in diminished player engagement and reduced retention rates. Gaming platforms and operators may witness a decline in user activity, affecting their revenues and ability to sustain enticing prize pools and features that cater to the wider player audience.

4. Navigating Challenges For A Balanced Ecosystem

To maintain a balanced gaming ecosystem, operators and industry stakeholders will need to address the concerns of small stake players. This could involve exploring innovative pricing structures, offering special promotions or discounts, and collaborating with regulatory bodies to seek favorable tax policies for low-stake players. By ensuring that the GST implementation does not disproportionately impact this vital player segment, the industry can foster a more inclusive and sustainable gaming environment.

5. Fostering Opportunities For Growth And Afordability

The GST on online gaming has also raised legal and regulatory questions. As the online gaming landscape evolves rapidly, the interpretation and application of tax laws may prove complex. Additionally, clarifications may be required regarding the classification of various gaming services and the exact tax liabilities for operators and players.

Regulatory Challenges In Implementing The GST

The implementation of the 28% Goods and Services Tax (GST) in the Online fantasy sports industry presents a series of regulatory challenges. Enforcing the tax on online gaming platforms requires a thorough analysis of the complexities involved in transactions and revenue streams within the sector. Regulatory bodies may face a potential strain as they seek to ensure compliance and fair taxation, necessitating streamlined processes and comprehensive guidelines. Striking a delicate balance between regulation and industry growth becomes crucial to prevent stifling innovation and maintain a conducive environment for the Online fantasy sports industry's sustainable development amidst the GST's impact.

Adapting Business Models For Sustaining Player Engagement

As the 28% Goods and Services Tax (GST) challenges the Online fantasy sports industry, online gaming platforms are compelled to devise strategies to maintain player engagement amidst the new online gaming tax landscape. To mitigate the impact of GST on player participation, platforms can explore innovative pricing structures, offering loyalty programs, and introducing attractive promotions. To ensure the sustainability of the Online fantasy sports ecosystem, platforms must be agile in adapting their business models. Emphasizing value-added experiences, enhanced customer support, and more engaging gameplay can create a competitive edge, attracting and retaining players despite the online gaming tax burden.

The Online fantasy sports industry must also remain adaptable to changing consumer behavior and preferences. Collaboration among industry stakeholders and embracing technological advancements further strengthens the industry's ability to navigate the tax landscape and maintain a thriving and sustainable Online fantasy sports ecosystem.

Conclusion

Despite these challenges, there remains an air of optimism within the online gaming community. Industry players have the opportunity to adapt to this new online gaming tax landscape and engage their audience through innovation and creativity. Collaborative efforts can also play a pivotal role in navigating these changes successfully. Striking the right balance between taxation and sustainable industry growth is crucial for the Online fantasy sports sector to mature and showcase its resilience. Embracing these principles will not only help the industry to thrive but also ensure that it continues to be an inclusive and exciting part of India's ever-evolving digital entertainment landscape.